49+ can you write off interest paid on your mortgage

The limit is 375000 for married couples filing separate. Web This can save you a lot of money on your tax bill.

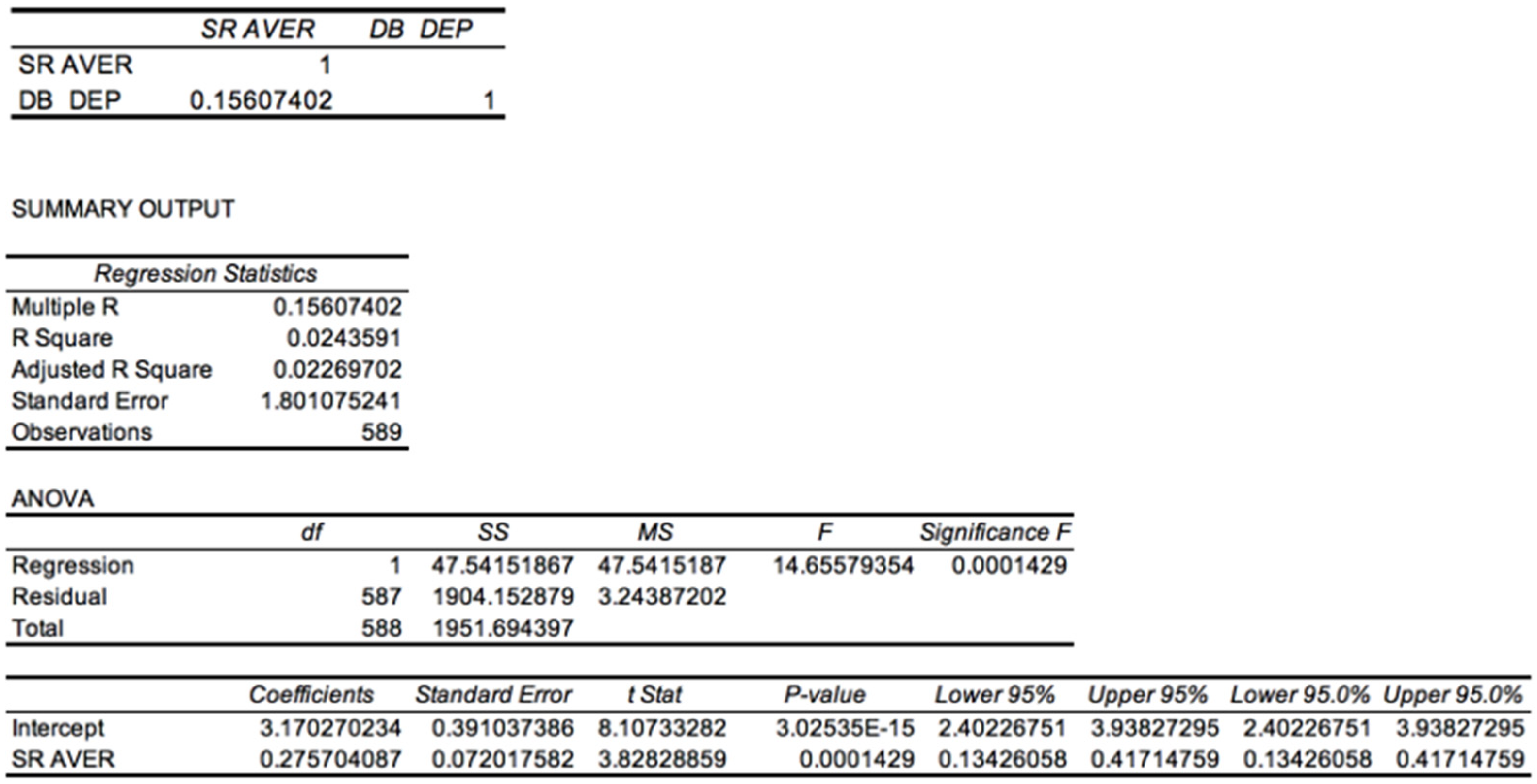

Sustainability Free Full Text The Nexus Of Social Cause Interest And Entrepreneurial Mindset Driving Socioeconomic Sustainability

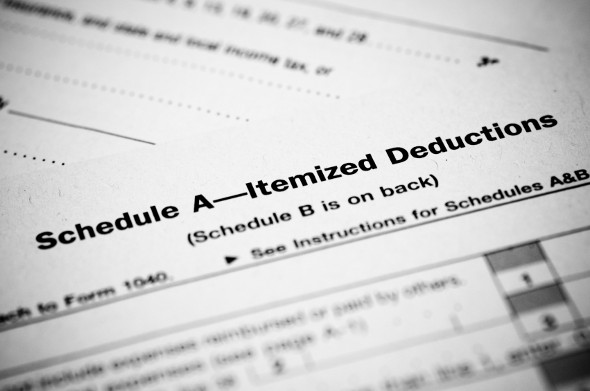

Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098.

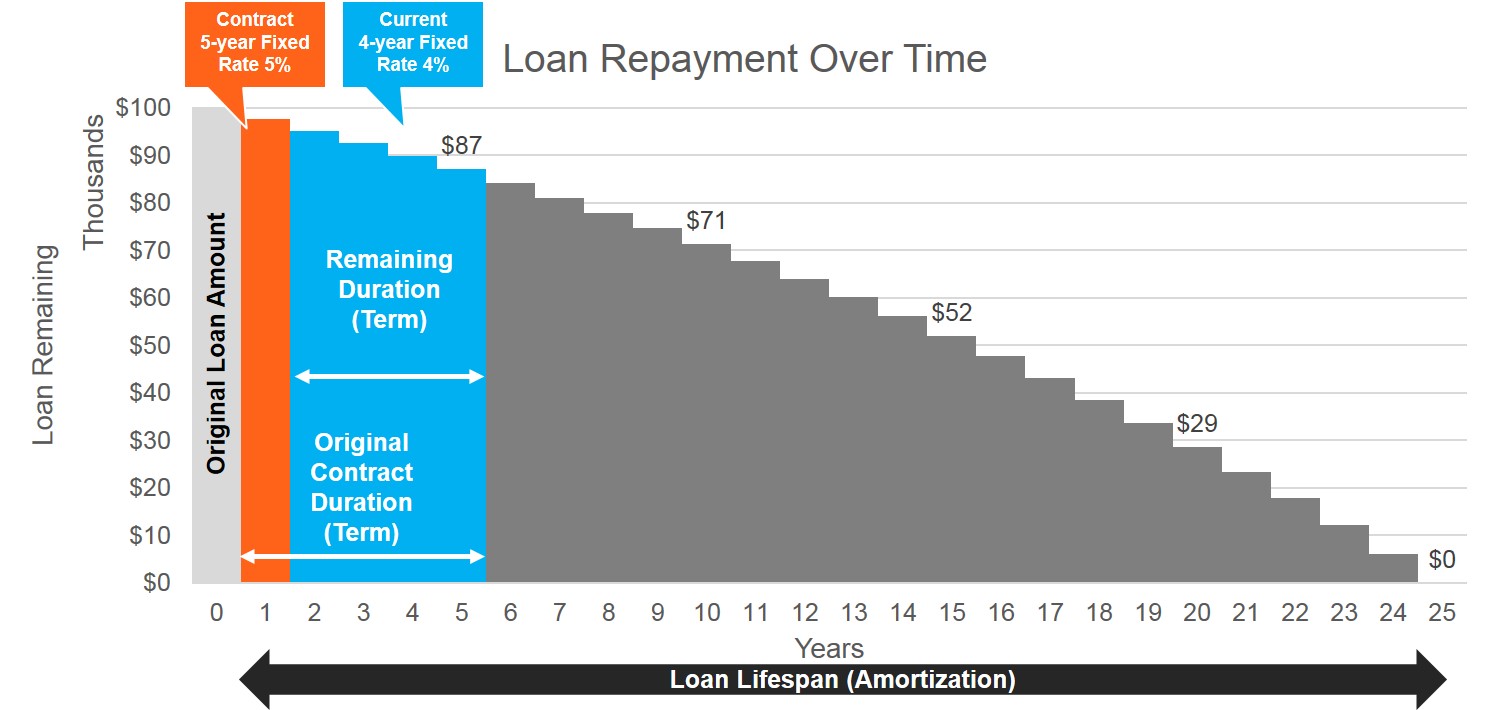

. This means when you file your taxes and have to pay a. However higher limitations 1 million 500000 if married. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

Web Claiming your mortgage interest can be an effective way to reduce your income and increase your deductions. Web You can write off the interest you pay on up to 1000000 of mortgage debt on your home or second home as long as you took out the mortgage to buy the property or to. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Web 11 hours agoYou should pay on time but you dont need to pay early. Find A Lender That Offers Great Service. If you owe the IRS money and are filing your tax return on April 18 then yes you should pay your tax bill.

The benefits of claiming your mortgage interest. LawDepot Has You Covered with a Wide Variety of Legal Documents. Web Reform caps the amount of mortgage debt for which you can claim an interest deduction at 750000.

Compare More Than Just Rates. You see in the US mortgage interest is considered tax-deductible. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

Create Your Satisfaction of Mortgage. At least in most circumstances you can. Web As well changes came into effect on Dec 15 2017 that lowers the amount a deduction can be claimed on.

Web As of the beginning of 2018 couples who file their taxes jointly are only able to deduct interest on up to 750000 of eligible mortgages which is down from 1 million. You can write off the interest you pay on up to 1000000 of mortgage debt on your home or second home as long as you took. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

The write-off is limited to interest on up to 750000 375000 for married-filing. Web The interest you pay for your mortgage can be deducted from your taxes. Ad Developed by Lawyers.

Web Most homeowners can deduct all of their mortgage interest. Web If you use a home loan to pay off high-interest debt buy a car take a vacation or pay tuition bills you cant claim the deduction on that interest. Ad Enter Your Mortgage Details Calculate Your Monthly Payment and Contact Lenders.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Today homeowners can deduct interest on a mortgage. Ad Increasing Mortgage Payments Could Help You Save on Interest.

Homeowners who bought houses before December 16 2017 can deduct.

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

P5 Jpg

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Penalties For Early Mortgage Repayment Prepayment Mortgage Sandbox

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Solved A Friend Plans To Purchase A 55 Inch Tv At A Particular Store At An Course Hero

49 Of The Best Remote Collaboration Tools For Productive Teams

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Mortgage Interest Deduction Bankrate

Mortgage Interest Deduction What You Need To Know Mortgage Professional

.jpg)

89 Insurance Statistics You Should Know Industry

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

The Trucker Clogs In A Bad Way Direct From Denmark

The Trucker Clogs In A Bad Way Direct From Denmark

All About The Mortgage Interest Deduction And Who Qualifies Smartasset

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service